A question we are asked over and over again is – “Will paying off my collections improve my scores?”.

Now in order to properly answer this question, let’s take a look at how the credit system works.

How Do Scores Drop?

First of all, a new collection account may take up to 7 years to report to your credit. Your creditor can report the negative balance right away, or you can wait 5, 6 years before it reports to your credit. There is no law stating a derogatory item has to be reported right away. As long as the derogatory item is within the statute of limitations, it can be reported to your credit.

Having that said, the scoring system will not look at the date that debt was generated (“date of first delinquency”) but at the date it was reported to your credit (“date of last reported”).

That’s right. You might have a debt that is 6 years old reported to your credit for the first time tomorrow, and the impact on your scores will be if that debt was brand new.

What Happens When You Pay Off an Old Collection?

Suppose you want to pay off an old collection. This collection was first reported to your credit 6 years ago according to the “date of last reported”.

When you pay off this collection, the creditor will be forced to update your balance to $0. When the creditor sends documentation to the bureaus stating this old collection has been paid, the bureaus will update the balance to $0 and the ‘date of last reported’ will be changed to the current date.

When the ‘date of last reported’ changes to the current date, the credit system will read as if you had a brand new collection reported to your credit and your scores will drop.

What Is The Impact On Your Scores When You Pay Off an Old Collection?

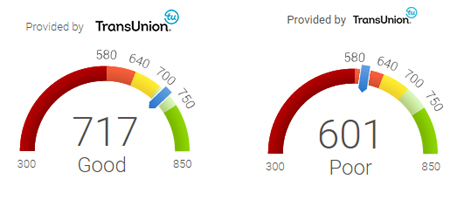

The actual impact on your scores will vary according to your credit history and the negative items you already have reported. A single newly paid collection can have the impact of 20-30 points score drop.

We have plenty of clients whose first reaction is to pay off all their old collections when they see their credit scores. We always wish they have spoken to us first.

So, What To Do Then?

Your goal should always be to remove a negative account instead of just paying it. By removing a negative account, your scores recover immediately.

Ways of removing a negative account are included but not limited to disputing its legitimacy, making a prior agreement with the creditor so the account is deleted when paid or waiting until the statute of limitations expires.

Ways of removing a negative account are included but not limited to disputing its legitimacy, making a prior agreement with the creditor so the account is deleted when paid or waiting until the statute of limitations expires. Disputing an account legitimacy will either remove the account completely or worst case scenario, you will be paying for an account that has proven through a myriad of ways to be yours. Remember – the burden of proof is always on the creditor, not on you.

Once an account has been fully verified, some creditors are willing to remove an account upon payment. This is a process we help our clients with.

Waiting for the statute of limitations to expire on an account can be a painfully lengthy process. An account may take the full 7 years from delinquency date to expire although we have seen it take much longer. As an account gets sold and resold multiple times, collection agencies knowingly or unknowingly report the wrong date of first delinquency, thus ensuring the account will remain reported for much longer. May clients believe an old account will “fall off on its own” but that is not necessarily true.

By looking at your report, we can tell you how we can help you. Contact us today and let our professionals change your scores.