According to bankrate.com “one in four adults has either no credit history or not enough active credit to generate a FICO score”. The majority of people who have no credit are young adults, the elderly (if they haven’t used credit in awhile), new immigrants and people who avoid credit. There are plenty of reasons why you need good credit.

According to bankrate.com “one in four adults has either no credit history or not enough active credit to generate a FICO score”. The majority of people who have no credit are young adults, the elderly (if they haven’t used credit in awhile), new immigrants and people who avoid credit. There are plenty of reasons why you need good credit.Many times, consumers with no credit history are new to the world of credit. Getting a credit score can be very bothersome as you need to have a credit history to get credit and you need to have credit to build a credit history.

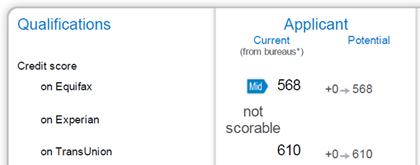

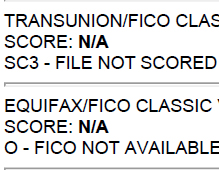

With no credit history, you are considered a high risk borrower. You will not qualify for the majority of credit available to most consumers such as credit cards, in-store accounts, installment accounts, etc. You will also have a hard time qualifying for mortgages or community bank loans, as many lenders are now requiring you to have at least 3 credit accounts in good standing. When you do qualify for a mortgage with no scores, your interest rate is differentiated.

What Causes You To Have No Scores?

Simply put, lack of credit history or insufficient credit data causes you to have no scores.

In order for you to have a score calculated, you need to have at least one account opened in the past 6 months. For a FICO score, your oldest account needs to be at least six months old, meaning you need to have at least 6 months of payment history reported. Using the VantageScore model, a consumer’s credit report could be scored after the first month of paying on a credit account.

So, How Do You Get Scores?

Building up your scores can be tricky. And you can do more damage than good if you do not know what you are doing.

1. Secured Credit Cards

A secured card requires a deposit (cash collateral) that becomes the credit limit for that account. For example, if you deposit $500 in the account, you can charge up to $500. You may be able to add to the deposit to add more credit, or sometimes a bank will reward you for good payment and add to your credit line without requesting additional deposits.

We have different secured cards available to you, but you can also apply for a secured card with your local credit union. Most local credit unions will not care you have no score or even a bad score.

2. Credit Builder Accounts

There are many loans specifically designed for people who do not have credit history. These loans are known as “credit builders”. Credit builder loans are typically extended by credit unions, precisely to help members build or rebuild credit reports and credit scores. Some community banks also offer them.

When a client applies for a credit builder loan, the loan is approved for some small amount, normally not much more than $1,000. But instead of the consumer getting that $1,000 like they would with a normal loan, the money is placed into an interest-bearing account with the credit union. The consumer makes payments monthly, and after a year or two, the loan is paid off, and the funds, plus interest, are released to the consumer.

Many furniture companies or companies such as RC Willey provide credit builder loans as well, at a higher interest rate. They usually require a 50% down payment and they finance the remaining 50% into monthly payments.

3. Authorized User Accounts

This is a simple and legal way to get scores and build credit. A credit card holder can add you as an authorized user to his/her existing credit card and the cardholder’s good payment history for that account appears on the authorized user’s credit record.

The risks:

a) If you are the authorized user: If the account holder misses payments, goes into collections or declares bankruptcy, that bad behavior will also show on your credit report.

b) If you are the card holder: The authorized user could max out the card and leave you with the bill.

One possible solution: If you want to add an authorized user, don’t give that person a card.

We have Authorized User Accounts specifically designed to build our client’s credit and provide them with scores and/or improve their existing scores. We add you on to credit cards that range from 15-month payment history, all the way to over 3 years, with credit limit ranging from $11,000 to over $30,000.

We have Authorized User Accounts specifically designed to build our client’s credit and provide them with scores and/or improve their existing scores. We add you on to credit cards that range from 15-month payment history, all the way to over 3 years, with credit limit ranging from $11,000 to over $30,000. Our authorized user accounts are risk free, with a full money back guarantee.

Read more about the accounts we have available.

4. Reactivate inactive accounts

Good accounts can disappear off your report after 10 years if they’ve been closed and/or inactive. In addition, some scoring formulas can’t generate a credit score if it’s been a while since any of your creditors reported to the bureaus.

If you fall into this category, you just need to make a small purchase. The statement will come, once you pay it, the creditor will report the account to the bureaus as active and your scores will be updated.

5. Rent Reporters

Although less and less common, some companies are able to report your rental payment history, if your landlord is in agreement. The landlord usually has to pay a fee to become a member of the service, and you as the renter has to pay a fee as well. Before taking this as one of possible solutions, contact your loan officer and request for additional details.

By looking at your report, we can tell you if you need to build additional credit and different scenarios that would further improve your scores. Contact us for more details.