When is a New Late Reported

We are always asked by our clients when a new late will be reported to their credit as they anticipate they will not be able to make a payment on time.

We are always asked by our clients when a new late will be reported to their credit as they anticipate they will not be able to make a payment on time.We have found many of our clients have a mistaken idea of when it happens.

Credit Card Lates

Credit cards are regulated by the Credit Card Act. The Credit Act ensures that you as a consumer has as many rights as a creditor does.A creditor may only report a new 30-day late to your credit when indeed you have paid your bill 30 days past its due date, meaning you have completely missed your minimum payment towards a billing cycle.

Being a couple of days late or even 29 days late past its due date isn’t grounds for a 30-day late to be reported to your credit. It is although grounds for a credit card company to charge you a late fee.

When the late fee is charged, you are then responsible for the minimum payment plus the late fee in order to avoid a 30-day late to be reported. If the balance of your minimum payment plus the late fee isn’t paid in full, you will have an outstanding balance which is grounds for a 30-day late.

Additionally, the Credit Card Act regulates the amount of the late fee to be imposed and safeguards against rate increases were you to be late.

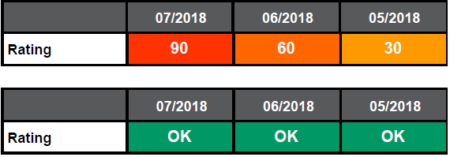

If you were to be over 30-day late, say 60 or 90-day late, the impact on your scores is much higher. Once a credit card account has been over 120-day late, many creditors will charge-off the account, meaning the account will not be reopened and its balance is now due in full.

Auto Loan Lates

Likewise, auto loans work in a seemingly fashion, where a new 30-day late cannot be reported to your credit until you are past 30 days late from it’s due date.Many lenders will attempt to repossess your car once the loan has been over 90 days late, although it is common for lenders to attempt to repossess your car when your loan is only 60 days late.

Your credit history of when you were first approved for the auto loan will define your lender rules. “High risk” consumers may have their auto repossessed as soon as 31 days late.

Student Loan Lates

Many student loans especially federal funded ones have a grace period. Meaning a student loan late might not be reported to your credit until it has been at least 90 days since you have missed your payment. When it has been over 90 days since you have missed your payment on its due date, a new 90-day late will be reported to your credit.Many student loans will add interest and late fees.

After 270 days of missing a student loan payment, your student loan goes from “delinquent” to “default”. Unlike delinquency, which still leaves you with a few options, defaulting means that your student loans are due in full and with any accrued interest or fines and penalties (such as fees charged by collection agencies).

Additionally, the government can begin garnishing your wages by up to 15 percent or even take your tax return in order to cover the costs of your missed student loan payment. And, believe it or not, your servicer could actually sue you.

Delinquency and default can be incredibly damaging for a cosigner as well. Once you are delinquent on a cosigned student loan, your cosigner’s credit will be severely impacted and collections may come after them or their property to recoup the loss.

How to Avoid Late Payments

To remain financially stable, make your payments on time. Here are three strategies to stay on top of the repayment process:1) Automatic Payments: The easiest way to remember to pay your loan is to have the money taken out automatically. Certain lenders even offer a discounted APR for enrolling in automatic payments.

2) Break Up Payments: If you can pay your loans weekly or bi-weekly, then pursue that option. It can be a struggle to pay $300 a month while living on a tight paycheck, but paying $75 a week can be more doable.

3) Let the Lender Know: When your financial situation is not the best and you know a late payment is unavoidable, call the lender and explain your situation. The lender might be able to grant you an extension. It is better to stay in contact with the lender and be upfront about your loan rather than trying to avoid them.

What To Do When a Late is Reported?

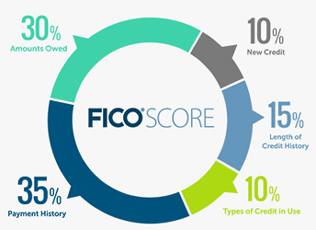

35% of your scores are made up of your previous payment history therefore a single late payment can really damage your scores.

We specialize in removing late payments through a myriad of ways – disputing its legitimacy, goodwill interventions, identity theft, to name a few.

Although it does not hurt for you to contact your creditor, explain your situation and request for removal of the new late. There is no law that states a creditor cannot remove a new late reported to your credit.

Understanding how scores work is very crucial in your credit repair process. Even though our money back guarantee isn’t score based, we understand the main reason clients sign up for our credit repair process is to raise his/her scores. We educate our clients when it comes to the different types of scores and different ways to improve existing scores.

Contact us today!