The Federal Fair Credit Reporting Act (FCRA) promotes the accuracy and privacy of information in the files of the nation’s credit reporting companies. Under the FCRA, both the credit reporting company and the information provider (that is, the person, company, or organization that provides information about you to a credit reporting company) are responsible for correcting inaccurate or incomplete information in your report. The way to have this information corrected and/or verified is by opening a “dispute” and verifying the accuracy of an account. Whenever the account is investigated, dispute remarks can be added to it.

As of recent, some lenders begin to dislike the dispute remarks. The dispute remarks are a small “price to pay” when the credit repair has improved your scores and making your chances of getting qualified much higher.

There are 2 types of Dispute Comments added to a client’s credit report.

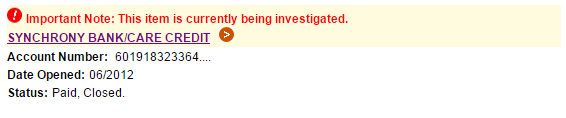

1 – Account currently being investigated:

When an account is currently being investigated, per FCRA rules and regulations, the bureau is required to add the remarks “currently under dispute” or “in dispute”. These remarks remain on your report throughout the investigation process, which may take up to 45 days.

When an account is “currently under dispute” a client may not qualify for a home loan until the account has been fully investigated. Furthermore, these remarks cannot be removed until then.

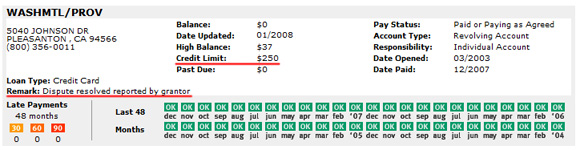

2 – Account disputed by consumer:

The key here is the past tense – disputed. This means that at a certain time, may it be in the distant past or recently, you have disputed the accuracy of this account. According to FCRA, the option to have an account verified is your right, even though some lenders dislike the dispute remarks.

There are multiple ways of removing these dispute remarks and they are all quite simple.

A – RAPID RESCORE

The loan officer gets a signed letter from you stating that you no longer dispute the specific account. The letter is sufficient to do a rapid rescore while processing the loan for underwriting and have the dispute remarks removed. Some loan officers are unaware of this option available to them, but many are quite on top of it.

B – BY YOU CONTACTING THE BUREAUS

Experian

Phone number: (714) 830-7000, Option 0 is answered by a live human being. Tell them you need the Executive Customer Service Team to remove the dispute remark(s). Hours are 8AM-5PM, Pacific Time.

Equifax

Phone number: (404) 885-8300 is answered by a live human being. Tell them you need to speak with someone in the Executive Consumer Service department to remove the dispute remark(s).

TransUnion

Phone number: (312) 985-2000 it has a machine greeting but just stay on the line and you are transferred to a live person, tell them you need to speak with someone in the Special Handling Department (or that you need help removing dispute comments). You will have to wait as they need to connect to customer service then get it elevated to the Special Handling Department.

If you cannot get the Special Handling Department, then when contacting the normal customer service representatives you need to say: “I need to dispute the compliance condition remarks code of “AID” (Account In Dispute) because I am no longer disputing the account.” You don not need to open a dispute, you need this handled while you are on the phone call. The customer service representative should be able to immediately end the dispute, as in during the phone call.

Contact us for more details.